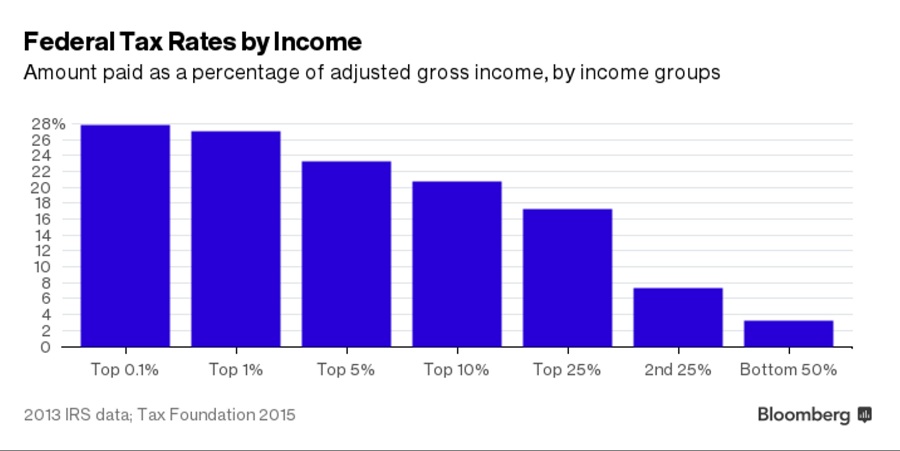

A lot of Americans feel like they're getting cheated at tax time. In a Pew Research Center poll last year, 61% said it bothered them "a lot" that "some wealthy people don't pay their fair share."

Try defining "fair share." But you can learn a lot about the U.S. tax burden by looking at five simple charts.

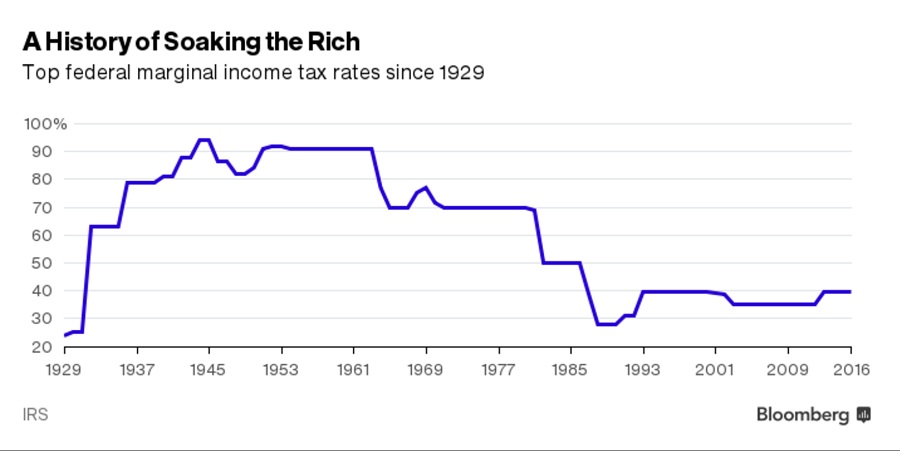

Certain well-paid people pay out a good chunk of their salaries. This year, a single filer owes the Internal Revenue Service 39.6% of any income over $415,050. That's up from 35% as recently as 2012, though it's nowhere near the rates the wealthy paid from the 1930s to the 1970s.

Advertisement

Of course, wealthy people don't often pay 39.6%. Many of them lower their rate with deductions, including those for charitable donations and mortgage interest. Also, that top rate mostly applies to salary income. Investors pay a top rate of 20% on qualified dividends and long-term capital gains, along with a 3.8% net investment income tax. That's one reason a well-paid executive, doctor or lawyer often ends up paying a higher tax rate than a wealthy heir living off investments.

How much do Americans pay in taxes overall?

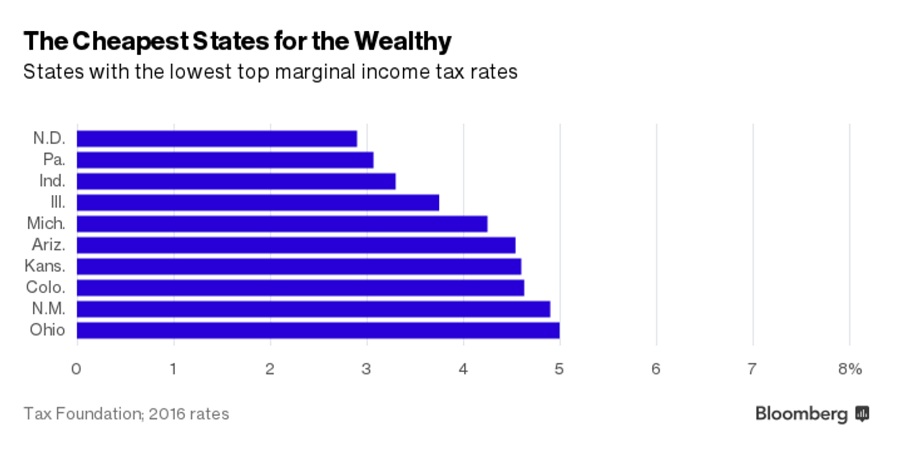

That doesn't include state income taxes, which can add 10 percentage points or more to your tax burden depending on where you live.

Meanwhile, seven states have no income tax at all: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Two more, New Hampshire and Tennessee, tax only interest and dividend income. Other states also have relatively low rates:

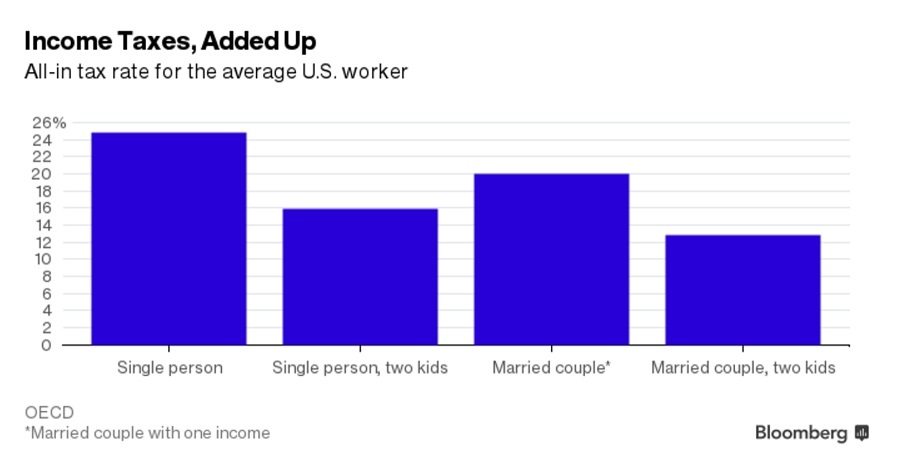

It can be misleading to measure Americans' tax loads only by their income taxes. U.S. workers also owe payroll taxes to Social Security and Medicare. These fall heaviest on low-income and middle-class workers, because only the first $118,500 in annual wages are subject to the standard payroll tax, 7.65% coming from employees and another 7.65% from their employers.

So how much does the average American worker end up paying each year, including his or her portion of payroll taxes and federal and state income taxes?

The Organization for Economic Cooperation & Development makes this calculation. For the U.S. in 2014, the most recent year for which data are available, the OECD figures the average single worker earned wages of about $50,000 and paid out 25% in state and federal income and payroll tax. Parents owed less because of deductions they can take for their children.

The tax burden is lower in the U.S. than in many other developed nations. Of 34 OECD countries, the U.S. tax rate for the average single American with no children ranks No. 17. The tax burden on a single person with two kids ranks 27th. Comparing tax rates across countries is difficult, however, without taking into account how much people benefit from their tax payments in college tuition, retirement income or more intangible rewards, such as security and the social safety net.

Focusing only on income taxes also leaves out the many other ways Americans get taxed, including local property and sales taxes and various fees and taxes on travel, tobacco, alcohol and fuel. These can add up, depending on where you live and how you live your life.

In New York City, for example, a pack of cigarettes carries a tax of $6.86. Of that, $1.01 goes to the federal government, $1.50 to the city, and $4.35 to the state — the highest rate in the country. In Missouri, it's just the federal tax and a state levy of 17�.